One of the most popular takeaways from SuiteWorld 2018 was the introduction of NetSuite's new tax feature: SuiteTax. NetSuite users will be delighted to hear that the product team has listened to your suggestions and delivered on some of the most important issues regarding taxes in NetSuite.

While we won’t discuss all of the SuiteTax improvements in-depth, here are some key highlights:

- Support for global operations including tax intensive countries such as Brazil, India and China

- Per Subsidiary and Entity tax registrations

- Automatic tax rate updates with effective date tracking

- Use Tax Support

- End-to-end tax reporting – from invoice to e-filing

- Advanced tax determination for complex business flows

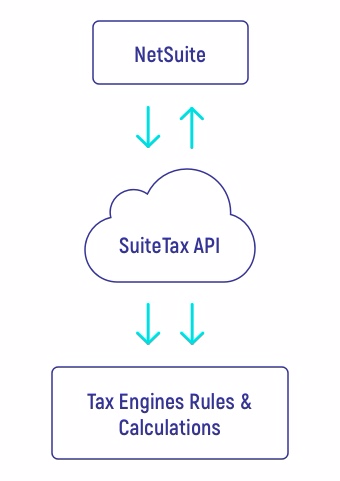

Architecture

SuiteTax’s flexibility is one of its greatest strengths. In the same NetSuite instance, you can now have multiple tax engines running simultaneously. The SuiteTax API will act as a layer between NetSuite and the tax engine or engines of your choice. For example, let’s say you have a subsidiary in Brazil and one in the US. With SuiteTax, you can configure NetSuite to manage all the taxes in Brazil with a comprehensive 3rd party engine such as Vertex and the US with NetSuite’s native tax engine.

Global Operations

Countries such as Brazil, India and China, which are very tax intensive, can now enjoy some of the great features from SuiteTax.

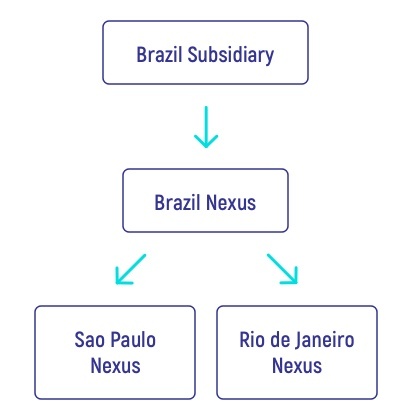

NetSuite uses the term nexus to describe a tax jurisdiction or a geographic area where a company does business with its own tax regulations. A nexus can be a country, municipality, city, state, province, county, or economic zone.

To determine the correct tax jurisdiction and tax rate, NetSuite needs to know where you are registered for tax purposes, as well as which tax engine has been assigned to that nexus.

In most situations, the nexus is a country because most countries charge tax only at the national level. Countries such as the U.S., Canada, and Brazil, however, will levy taxes at different levels and also have independent tax authorities in addition to the national level. With the SuiteTax feature enabled, you can create a hierarchy of nexuses. A country can have one national-level nexus, and that nexus can have multiple sub-nexuses within a single subsidiary. Here’s a small chart to display this concept:

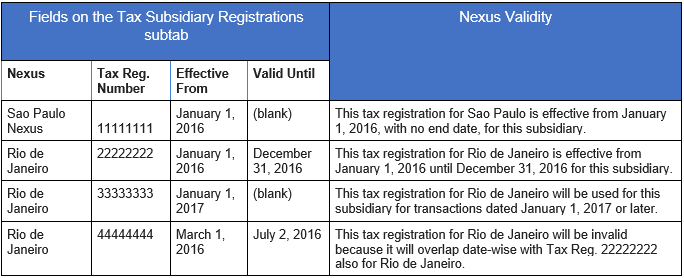

With SuiteTax, you can define tax pertinent details on the Tax Registration tab which is available at the Entity (Vendor, Customer, Partner, Leads, Prospect) or subsidiary level. This following table illustrates just some of the fields on the subtab as well as the new capabilities of this new feature.

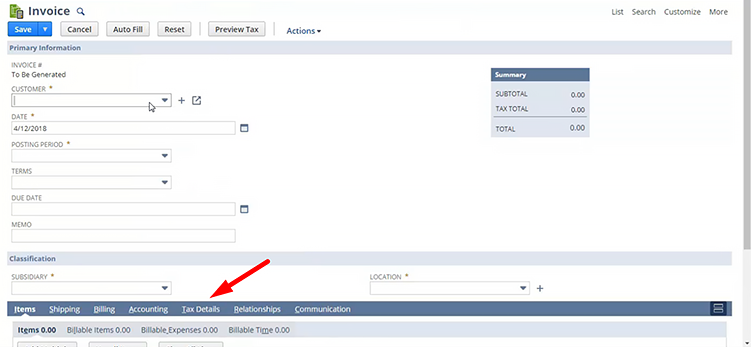

SuiteTax and Transactions

With a SuiteTax-enabled account, transaction forms will now include a new Tax Details subtab and a standard NetSuite Summary box now with a lot more detail. Here’s a look at the new Tax Details subtab and its fields:

- Tax Details:

- Tax Details Reference – Links the tax line to its corresponding line item

- Tax Type

- Tax Code

- Tax Basis

- Tax Rate

- Tax Amount

- Details – Shows the information returned by the tax engine used to calculate the tax

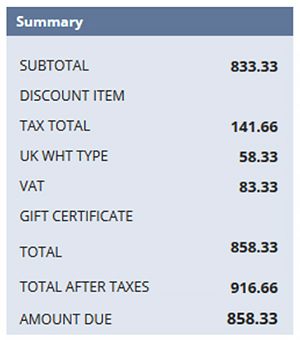

When you click Save on a transaction, the amounts for the tax summary and tax details are calculated by the appropriate tax engine. The system uses the nexus lookup logic to determine which tax engine to use. If you want to see the calculated amounts before saving a transaction, there is a new Preview Tax feature. The calculated amounts sent back by the tax engine are shown on Tax Details subtab and Summary Box. Preview amounts are saved only when you save the transaction record. Here’s what the new Summary Box will look like:

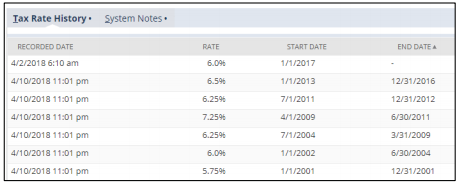

Effective Dates

Tax rates will be downloaded and managed automatically with SuiteTax. Additionally, it will provide a detailed history of the effective dates of each tax rate change over time.

SuiteTax Reporting

Among the reports, SuiteTax provides a standard tax report which includes tax lines from new and migrated transactions. Localized reports that are available in legacy are no longer available in SuiteTax. The legacy tax information is exposed through the tax details on transactions. The tax engine reporting can use the tax details for reporting both legacy and SuiteTax transactions. For localized report solutions, consult your tax engine provider. Here’s what is provided:

Generic Tax Report

Taxable Transactions List

Basic Transaction Details

Country Tax Reports

Localized Form

Local Language

Enabling SuiteTax and Migration Process

SuiteTax is a beta feature and is currently available only to a small set of partners and customers. If you want SuiteTax today, you will have to go through a qualification process with the help of your NetSuite Account Manager. Once qualified, you will have to turn on SuiteTax in your enabled features as well as install the SuiteTax SuiteApp. As of 2019, all new customers will be provisioned with SuiteTax.

The NetSuite team has done their best to make the migration process as seamless as possible. Most of the process is significantly automated with minimal downtime as the migration of tax records is done in the background. Here is a summary of the overall migration process:

1. Pre-Migration

Tax Engine Installation

Tax Engine set Up

2. Enable SuiteTax

Migration of Tax records

Migration of Transactions for the last 3 years

3. Complete Tax Setup

Select your tax engine for each Nexus

While SuiteTax is a huge leap forward for NetSuite, there are still more features needed and there is planned roadmap.

As a fellow implementer of NetSuite for many years, SuiteTax solves for many of the pain points I’ve seen customers face over the span of many projects. I cannot count the number of times the topic of Use Tax brought frustration to potential clients when they found out that NetSuite does not handle Use Tax natively. In my experience, Brazilian companies become discouraged to the point of stalling a NetSuite implementation when they heard how few of their tax regulations were handled with NetSuite. Fortunately, SuiteTax is a great step in the right direction and a welcome addition to the global path NetSuite is striving for.

The main theme at SuiteWorld was heard loud and clear that NetSuite is really going global. These fundamental enhancements to the SuiteTax engine to support the most complicated international tax jurisdictions are a sign of that Oracle is committed to continued success in the emerging markets around the globe. I hope you enjoyed our thoughts on this topic and if have any questions or comments about the new SuiteTax changes, please feel free to share below.

Get Started Now

The easiest way to get started is to contact Techfino today. If you’d like a little more information first, you can download our ContinuedSuccess Whitepaper. Either way, we hope you’ve found this guide helpful and hope that we can further assist you on your path to leveling up your NetSuite Support.