Welcome to part three of our Go-Live Success blog series! In this section we will cover cutting over open Accounts Receivables and sales orders in NetSuite.

Once inventory setup is complete, it is time to establish open Accounts Receivable balances in NetSuite. This will allow you to process payments directly in NetSuite without worrying about your old system.

Establishing open accounts receivables is pretty straightforward. For each open invoice, we need the following standard invoice field values:

- Invoice Number

- Customer

- Due Date

- Amount Remaining

- Memo/Description

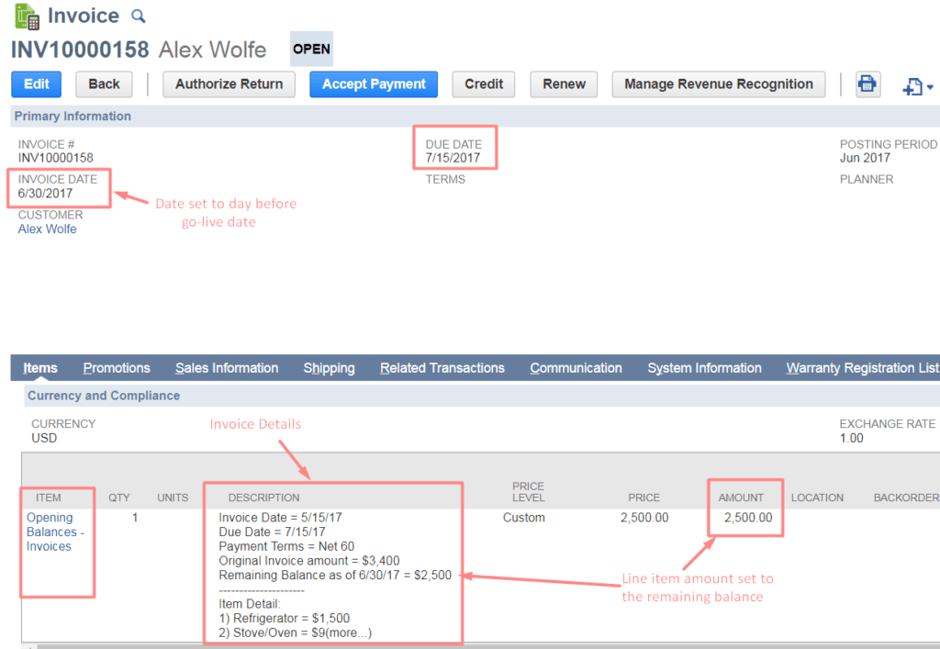

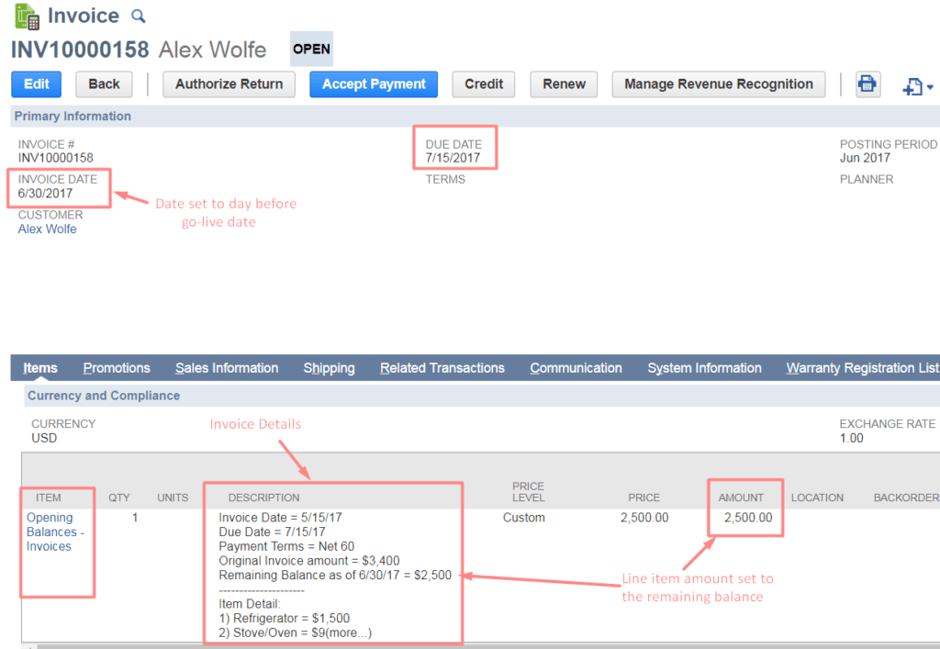

Note that the transaction date is excluded in the list above. When importing open invoices, the transaction date will be set to the day before the go-live date instead of the actual posting date. The reason is that we need to reverse the GL impact of these imported invoices later on, which is easiest to do when all invoices are in a single posting period.

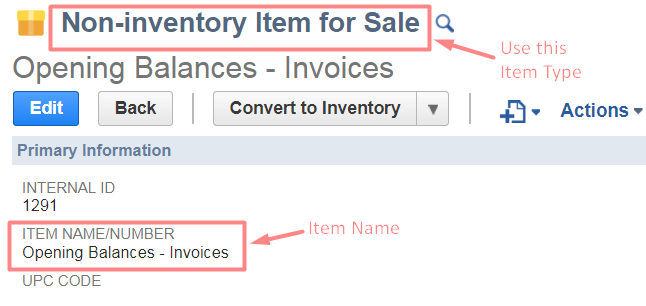

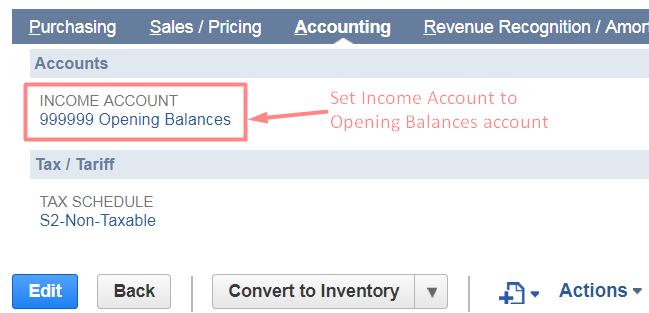

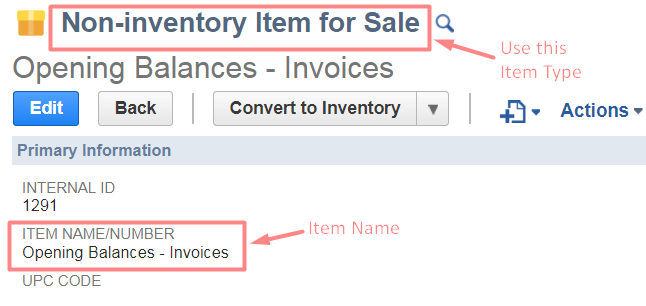

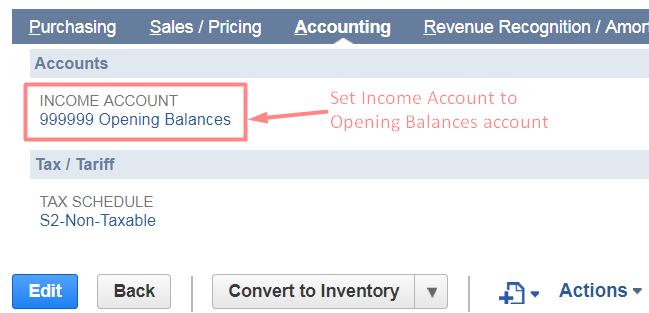

In preparation for the invoice import, you’ll need to create a dummy Non-Inventory for Sale item used specifically for this exercise, such as an “Opening Balances - Invoice” item. This item will post to a dummy GL account that is also used for this exercise, such as an “Opening Balances” account.

It’s important to note that in setting up the file, the actual line item detail of the original invoice will not be included. Instead, we are replacing the details with a single line, where we will use the new “Opening Balances” item. Also, the amount entered for this invoice will only be for the remaining balance due to be paid instead of the original amount.

Even though all of the line items of the original invoice aren’t included, this is easily solved by adding a summary of the original invoice details in the “Opening Balances” item. This will give a way to reference the original invoice without worrying about the hassle of importing the exact line items.

Putting it all together, each invoice will look like this:

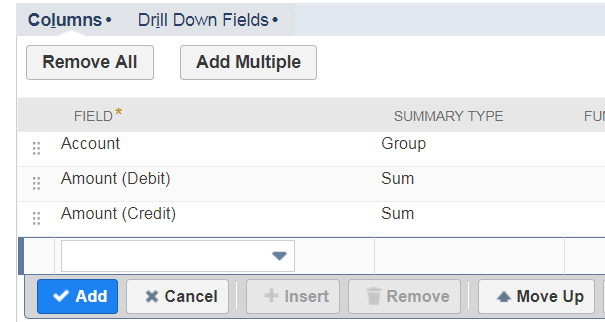

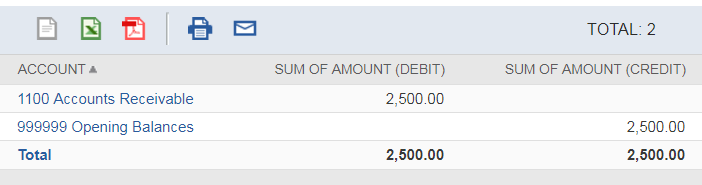

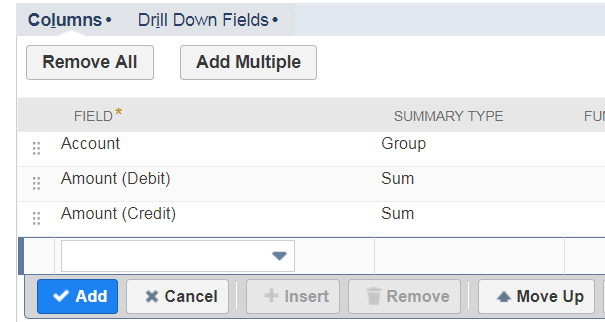

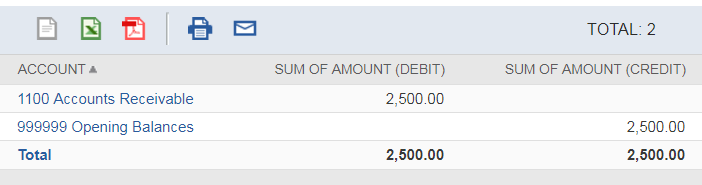

Once all open invoices have been imported, journal entries must be created to reverse the net GL impact of those invoices. A saved search can be used to aggregate the GL impact of all invoices created. Since we started with a clean NetSuite account and have only created inventory worksheets and adjustments up to this point, it will be easy to set a filter for all invoices and sum their GL impacts. The journal entry itself is simply a matter of reversing the total debits and credits of the invoices.

After you’ve created the Journal Entry, you’re all done with establishing open A/R!

However, there is one more item to consider at this time; deciding how to manage open sales orders.

Let’s first understand the different states in which sales orders can exist and how we can proceed with each:

- Order is open but no transactions so far

- Order is partially fulfilled, but needs to be invoiced

- Order is partially fulfilled and invoiced

The first scenario is the easiest to deal with. If there are open orders but have not had any related activity, there are two options:

- Import all open orders

- Enter the sales order when it’s time to fulfill or invoice the customer

The first option is great if you have a large amount of orders to re-enter into NetSuite. When setting up this import though, we’ll need the exact item detail to fulfill them at a later time. This requires the additional work of ensuring your item master is all set (which it should be before establishing inventory) and mapping to those items on the sales order import.

The second option is best if there aren’t many open sales orders. It also gives the end user the ability to manually review each order and understand how the order translates into NetSuite. This is especially helpful as users are getting used to NetSuite moving forward.

For orders that have been fulfilled and/or invoiced, it is best to not create them at all. It becomes a very tedious exercise of having create all these orders, item fulfillments and invoices to reflect the remaining balance on an order. It becomes even more complicated if those invoices have payments applied to them, which would also need to get created as well. Lastly, you would then have to reverse the net GL impact of all of these transactions - needless to say, this process is quite complex.

Instead, it’s best to utilize standalone invoices as existing orders are fulfilled. The biggest benefit of a standalone invoice is that it will handle the revenue recognition and the inventory cost calculation at the same time. Although this invoice will not be linked to a sales order, it is a very small price to pay for the simplicity of managing fulfillments from existing orders.

I hope you are finding this series helpful and stay tuned for the fourth part of our Go-Live Success series.

Leave us your thoughts and comments below!